6 Reasons Your SME Should Adopt Buy Now, Pay Later (BNPL) in 2025

By Eric Lian · 8th February, 2022

Table of Contents

This blog was updated on 06 May 2025, for more information connect with our team: https://www.easystore.co/contact

6 Reasons Your SME Should Adopt Buy Now, Pay Later (BNPL) in 2025

As ecommerce continues to grow in Malaysia, many traditional processes in online business operations are being replaced by newer, more efficient alternatives.

The impact of COVID-19 brought about salary cuts and job losses, which significantly shifted consumer purchasing behavior.

One of the most notable changes in recent years is the rise of Buy Now, Pay Later (BNPL).

What started as a financing solution mainly used for high-ticket items has now become a preferred payment method for a wide range of products.

In fact, many consumers now prefer BNPL over credit cards. As a result, more businesses are integrating BNPL into their operations.

But what exactly is BNPL, and how can it benefit your business? Let’s take a closer look.

What is BNPL?

Buy Now, Pay Later (BNPL) is commonly associated with installment-based payments.

While traditional installment plans give consumers payment flexibility, they also come with longer payment cycles and greater risk for businesses—especially if a customer defaults.

With the BNPL model, however, your business gets paid upfront, while the BNPL provider assumes the responsibility and risk of collecting payments from your customers.

In simpler terms, your customers pay over time, and you get paid immediately—a win-win for both parties.

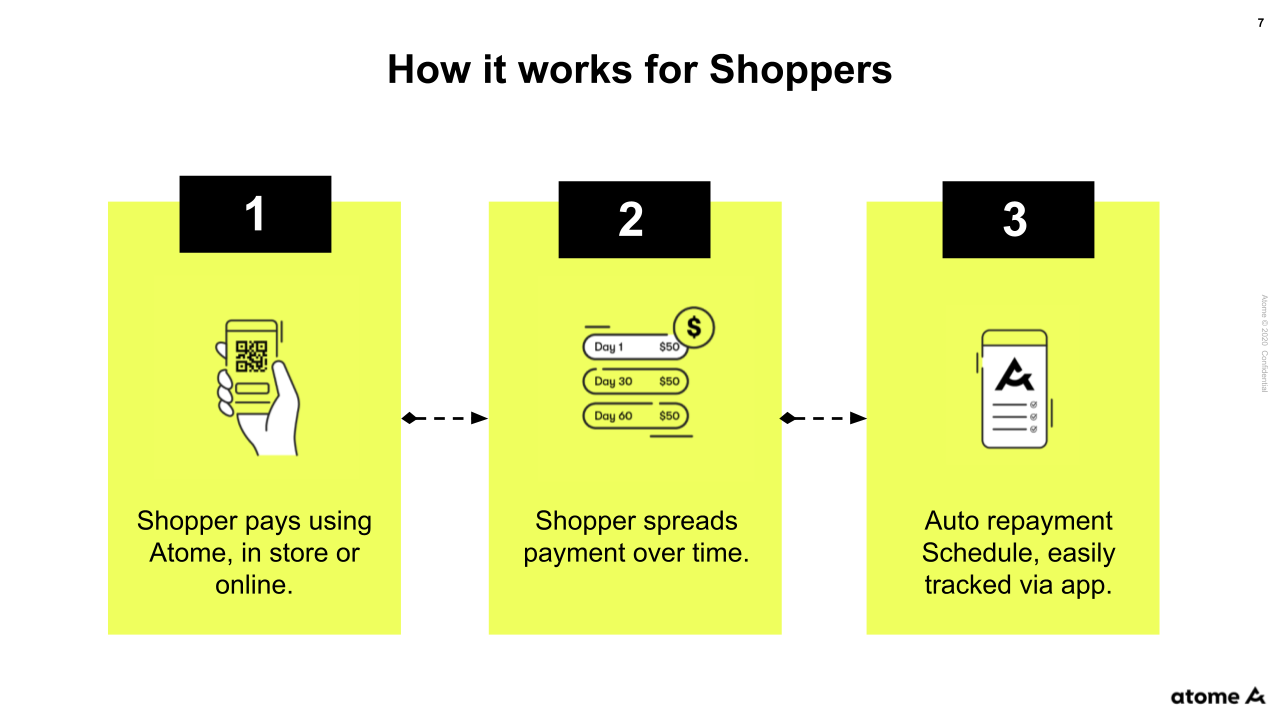

How Does It Work?

When a customer makes a purchase using BNPL, the total payment is divided into equal installments—typically over 3 or 6 months—with 0% interest and no administrative fees.

As the merchant, you receive the full payment (minus transaction fees) within a few days. The BNPL provider assumes full liability for the transaction.

Photo source: Atome

Why Are Consumers Choosing BNPL?

1. More Affordable Purchases

BNPL offers an affordable alternative to credit cards by allowing consumers to spread payments over time without incurring interest or additional fees.

This lowers the barrier to entry for higher-value purchases, especially for younger consumers like Gen Z who may not qualify for credit cards.

2. Flexible Payment Options

BNPL gives consumers the option to choose flexible payment terms—typically between 3 to 6 months—based on the provider.

This flexibility reduces friction in the purchasing process and makes it easier for customers to commit to a purchase.

Why Should Your Business Offer BNPL?

1. Gain a Competitive Edge

Nearly half of consumers prefer shopping with retailers that offer BNPL.

If your competitors are already offering it, not having BNPL could put your business at a disadvantage.

Adding BNPL to your checkout process helps you remain competitive—or even stand out—in the marketplace.

2. Boost Overall Sales

Offering BNPL can increase your overall sales by 20% to 30%.

Customers are more inclined to complete purchases when flexible payment options are available, making them more comfortable buying multiple items at once.

3. Increase Average Order Value (AOV)

When customers know they can spread payments over time, they’re more likely to add additional items to their cart. This contributes to a higher basket size and increases your store’s Average Order Value.

4. Enhance Customer Lifetime Value (CLV)

While acquiring new customers is important, retaining them is crucial for long-term success. BNPL encourages repeat purchases by offering convenience and flexibility, increasing customer loyalty and lifetime value.

5. Attract New Customers

BNPL can turn potential leads or “window shoppers” into paying customers. Many consumers are held back by high upfront costs. BNPL removes that barrier by allowing them to pay later with no interest, increasing the likelihood of conversion.

6. Reduce Cart Abandonment

According to Mastercard, offering BNPL can reduce cart abandonment by up to 35%. One of the main reasons for cart abandonment is the perception that the total price is too expensive. By offering BNPL, you minimize this obstacle and motivate customers to complete their purchases.

Also, check out 12 Proven Strategies to Recover Abandoned Carts and Boost E-commerce Sales

Who Should You Partner With?

EasyStore leads the way with the most BNPL integrations in the market, helping your business scale faster and smarter.

Choose from a range of providers based on what fits your needs best.

BNPL providers integrated with EasyStore include:

P/S: More integrations are on the way!

Final Thoughts

Implementing a Buy Now, Pay Later (BNPL) strategy is no longer just a trend—it’s a smart business move.

If your business hasn’t adopted BNPL yet, 2025 is the perfect time to start.

Make Customers Love Buying From You

EasyStore empowers your brand to prioritize customers and enhance their experience, creating a unified customer experience (UCX) that makes customers love buying from you.

Over 50,000 brands have grown their businesses by embracing unified customer experiences (UCX) strategy through EasyStore across multiple sales channels - online store, retail outlets, marketplaces, and social media, ensuring consistency in product and service offerings for a seamless shopping journey.

Embrace UCX and redefine your business success today

Discover how UCX can elevate your customer engagement with a truly unified journey for your customers, streamline operations, and drive growth across all channels.

Contact Us