Buy Now, Pay Later: A Smarter Alternative to Credit Cards?

By Firdaus Arif · 15th June, 2021

文章目錄

This blog was updated on 30 April 2025, for more information connect with our team: https://www.easystore.co/contact

Buy Now, Pay Later: A Smarter Alternative to Credit Cards?

Both credit cards and Buy Now Pay Later (BNPL) services offer flexible ways to shop and pay over time — but the user experience, approval process, and cost structure between the two differ significantly.

As consumers look for simpler, more transparent payment options, BNPL is becoming a preferred method across Malaysia.

Market Trends in Malaysia

According to The Global Economy, only 21% of Malaysians own a credit card, while 73% have a debit card.

The lower adoption of credit cards is largely due to complex application processes, strict eligibility requirements, and rejection risks.

This lack of access has left many Malaysians unable to convert large purchases into manageable installments — until now.

Buy Now Pay Later services are rapidly gaining popularity in Malaysia, offering accessible, flexible payment solutions across industries like fashion, travel, tech, and more — often with zero-interest plans.

Why BNPL is Gaining Traction

BNPL is growing fast globally because it offers a clear product-market fit.

Here’s why consumers are embracing BNPL options:

1. Transparent & Interest-Free

BNPL platforms typically offer zero-interest installments without hidden fees, making them a more transparent choice for consumers who want to avoid long-term debt.

2. Frictionless Checkout Experience

BNPL options are embedded directly into a merchant’s checkout process, making it faster and easier for shoppers to complete their purchases — especially online.

3. Real-Time Budgeting

With BNPL apps, users gain instant visibility into their repayment schedule and past transactions.

This encourages better budgeting and financial planning, compared to credit card statements that arrive only monthly.

For Millennials, BNPL is the Clear Winner

For younger generations wary of debt, BNPL provides a more responsible and accessible way to manage spending.

Compared to credit cards, BNPL offers:

Instant approvals without hard credit checks

No interest or late fees (if paid on time)

Full transparency and real-time payment tracking via mobile apps

Try BNPL with myIOU

Download the myIOU app on the Apple Store or Google Play and explore a smarter way to pay.

With myIOU, you can split your purchase into up to 6 monthly repayments with ease.

For merchants, enjoy a limited-time free sign-up promotion.

Sign up with myIOU here and an Account Manager will get in touch to help you get started.

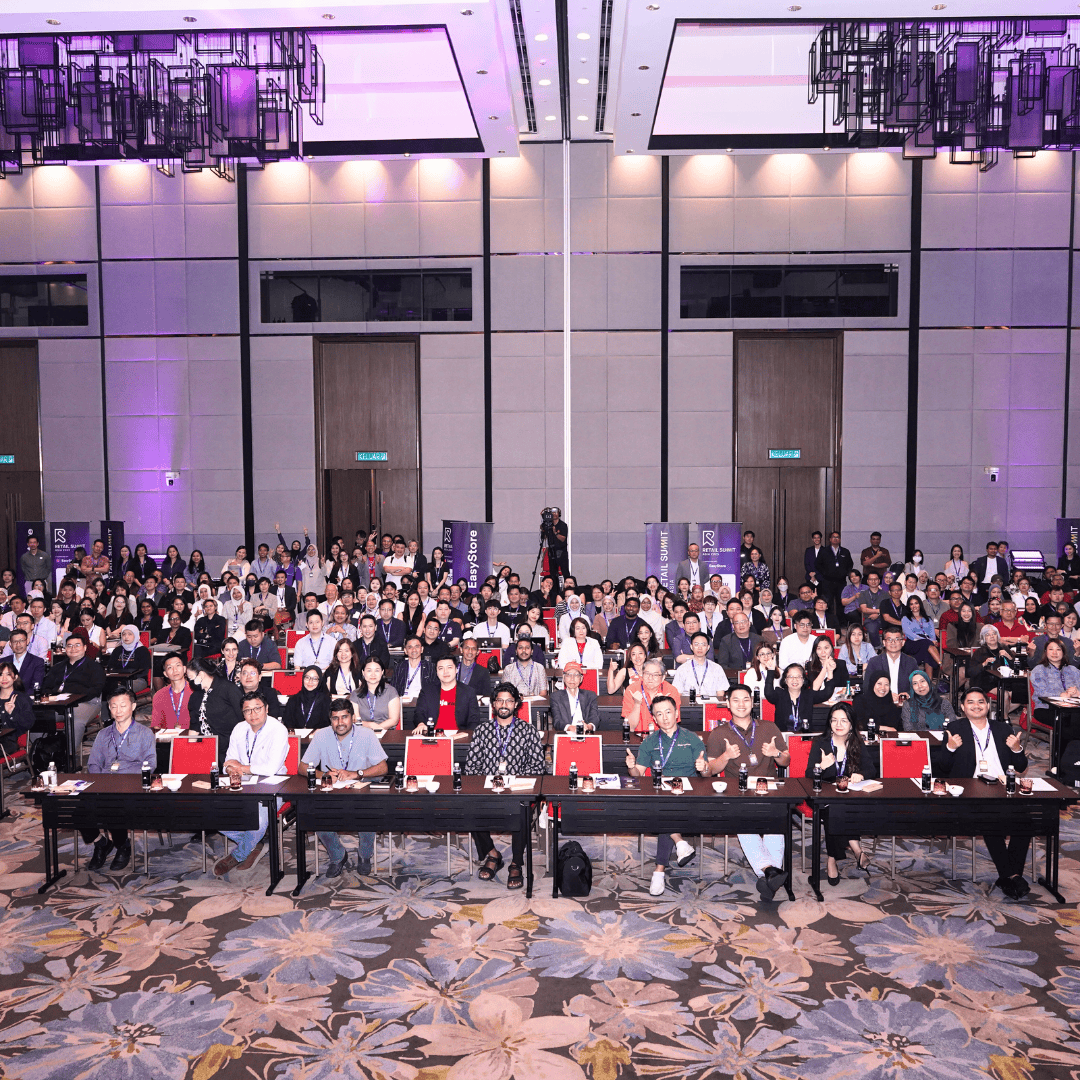

Make Customers Love Buying From You

EasyStore empowers your brand to prioritize customers and enhance their experience, creating a unified customer experience (UCX) that makes customers love buying from you.

Over 50,000 brands have grown their businesses by embracing unified customer experiences (UCX) strategy through EasyStore across multiple sales channels - online store, retail outlets, marketplaces, and social media, ensuring consistency in product and service offerings for a seamless shopping journey.

Embrace UCX and redefine your business success today

Discover how UCX can elevate your customer engagement with a truly unified journey for your customers, streamline operations, and drive growth across all channels.

Contact Us