Worried About RM 30,000 E-Invoice Fines? EasyStore Got You Covered!

By Cavan Koh · 30th July, 2024

Malaysia e-Invoicing Implementation Starting August 1st

The Inland Revenue Board (IRB) has announced that the e-Invoicing initiative will roll out in phases beginning in August 2024.

e-Invoicing will apply to all taxpayers engaged in commercial activities within Malaysia, covering both domestic and international transactions.

e-Invoice Implementation Timeline

| Implementation Date | Annual Revenue or Turnover Threshold |

| 1st August 2024 | Applicable to taxpayers with annual turnover > RM 100 million |

| 1st January 2025 | Relevant for taxpayers with annual turnover between RM 25 million and RM 100 million |

| 1st July 2025 | Applicable to taxpayers with annual turnover between RM 500K to RM 25 million |

| 1st January 2026 | Applicable to all businesses |

Disclaimer Notice: Please note that any information regarding e-invoicing may be subject to change based on government updates. For the most current and accurate information, kindly refer to the official website of the Inland Revenue Board of Malaysia (LHDN).

What is an e-Invoice?

An e-invoice, or electronic invoice, is a digital version of a paper invoice used in business transactions. It contains the same information as a traditional invoice but is created, transmitted, and stored in a digital format. E-invoices streamline the invoicing process, reduce errors, and improve efficiency.

4 Types of e-Invoices

- Invoice: A document issued by a seller to a buyer, detailing the products or services provided and the amount due.

- Debit Note: A document issued by a seller to a buyer, indicating an increase in the amount owed due to errors in the original invoice or additional goods/services provided.

- Credit Note: A document issued by a seller to a buyer, indicating a reduction in the amount owed due to returns, errors in the original invoice, or discounts.

- Refund: A document issued to return funds to a buyer, usually due to a product return or overpayment.

Two Ways to Submit an e-Invoice

There are 2 ways to submit and e-invoice, upon successful transactions, businesses may choose to perform:

- Manual Submission via Myinvois Portal: Log in to the Myinvois portal, upload the e-invoice manually, and submit it.

- Automated Submission via API Integration: Integrate your invoicing system with the Myinvois API to automate the submission process, reducing manual effort and errors. EasyStore offers free API e-Invoice submission.

Steps to Activate e-Invoice with EasyStore

Ready to enable e-Invoicing for your business? Here’s a step-by-step guide to help you get started quickly with EasyStore’s e-Invoice integration.

Step 1: Register for a Myinvois Account

You'll need to register a MyInvois account on LHDN's website

Already have a MyInvois account? You can skip this step!

How to Register:

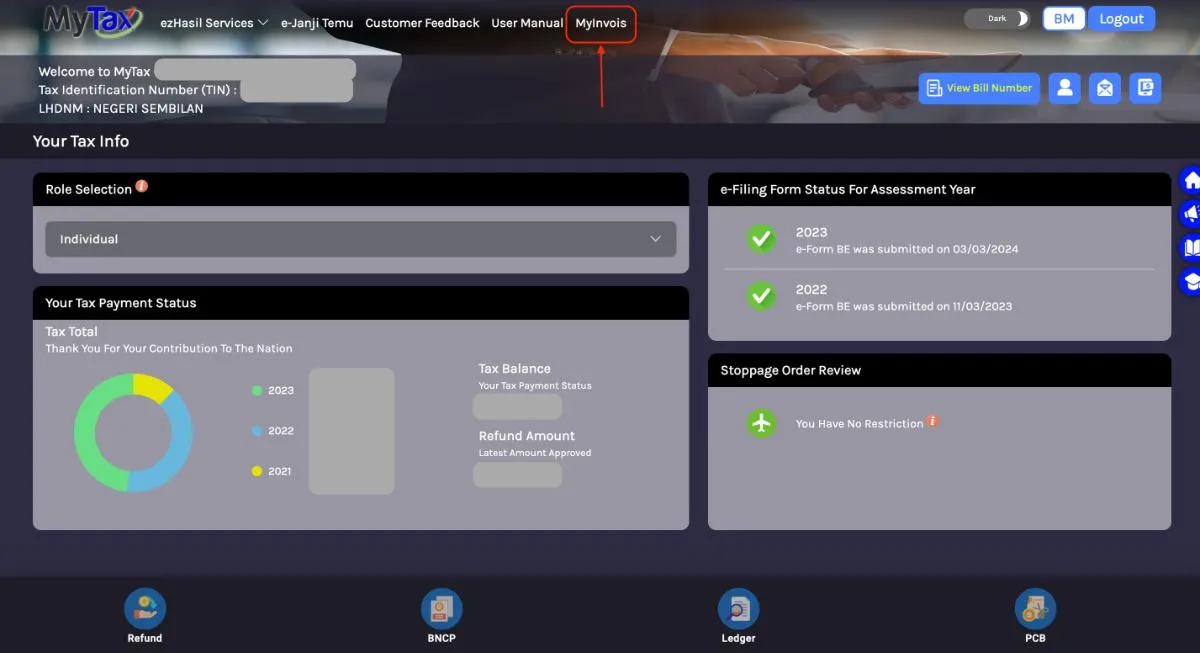

- Go to https://mytax.hasil.gov.my/.

- Log in by selecting your User Identification Type and entering your identification number.

- Navigate to the MyInvois section and complete the setup process.

Step 2: Set Up EasyStore as Your Intermediary

Once your MyInvois account is ready, the next step is to connect EasyStore as your intermediary. Follow the steps below and refer to the screenshots for visual guidance.

1. Access Taxpayer Profile: Log in to your MyInvois Portal and click on Taxpayer Profile (see image below).

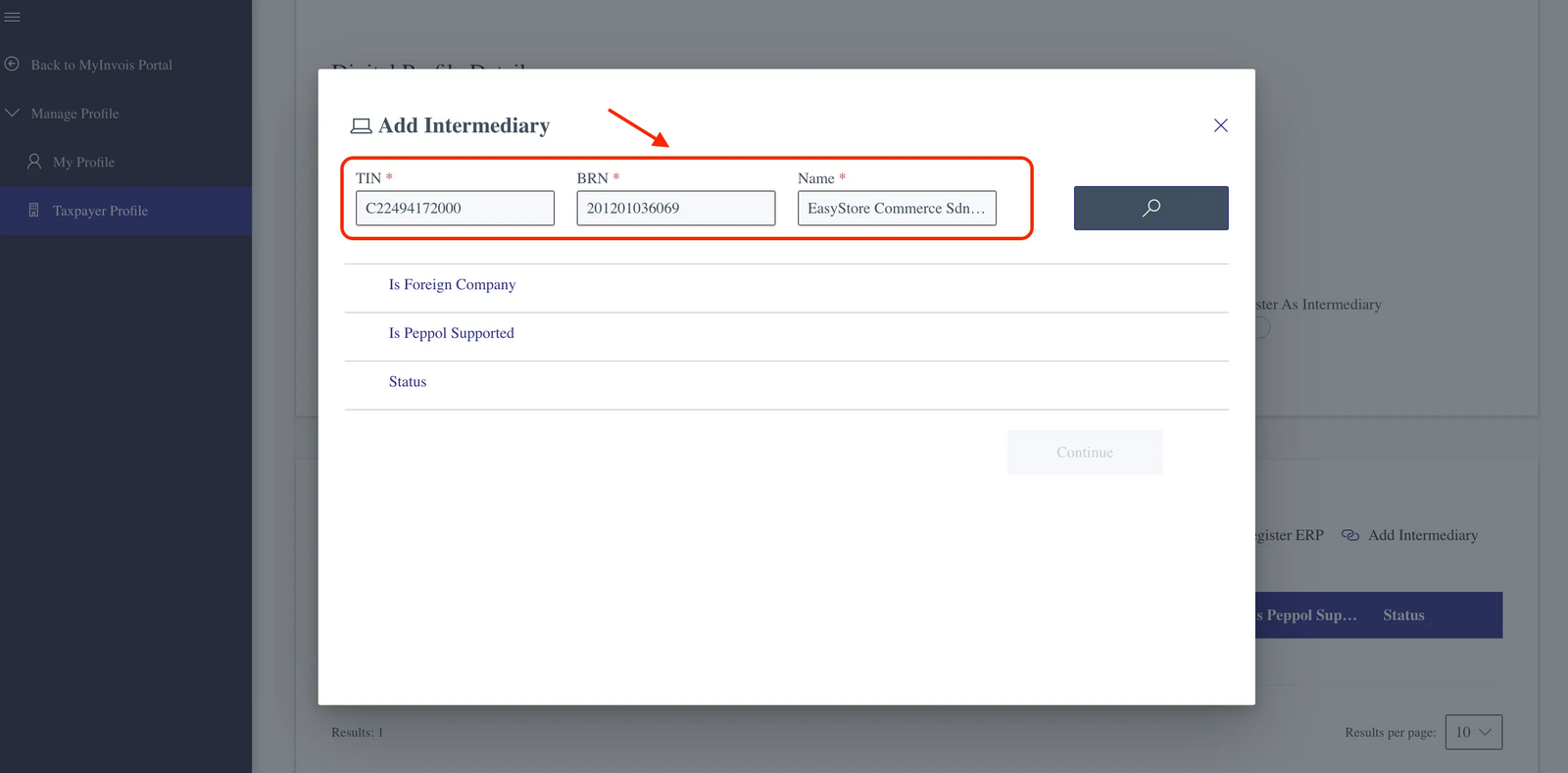

2. Select "Add Intermediary": Scroll down to the Representatives section and click “Add Intermediary.”

3. Enter EasyStore Details: On the “Add Intermediary” page, enter the following EasyStore details.

- TIN: C22494172000

- BRN: 201201036069

- Name: EasyStore Commerce Sdn. Bhd.

Note: Make sure you’re entering EasyStore’s information here, not your own business details.

4. Validate and Continue: Click the Search button to validate the data, then click Continue to proceed.

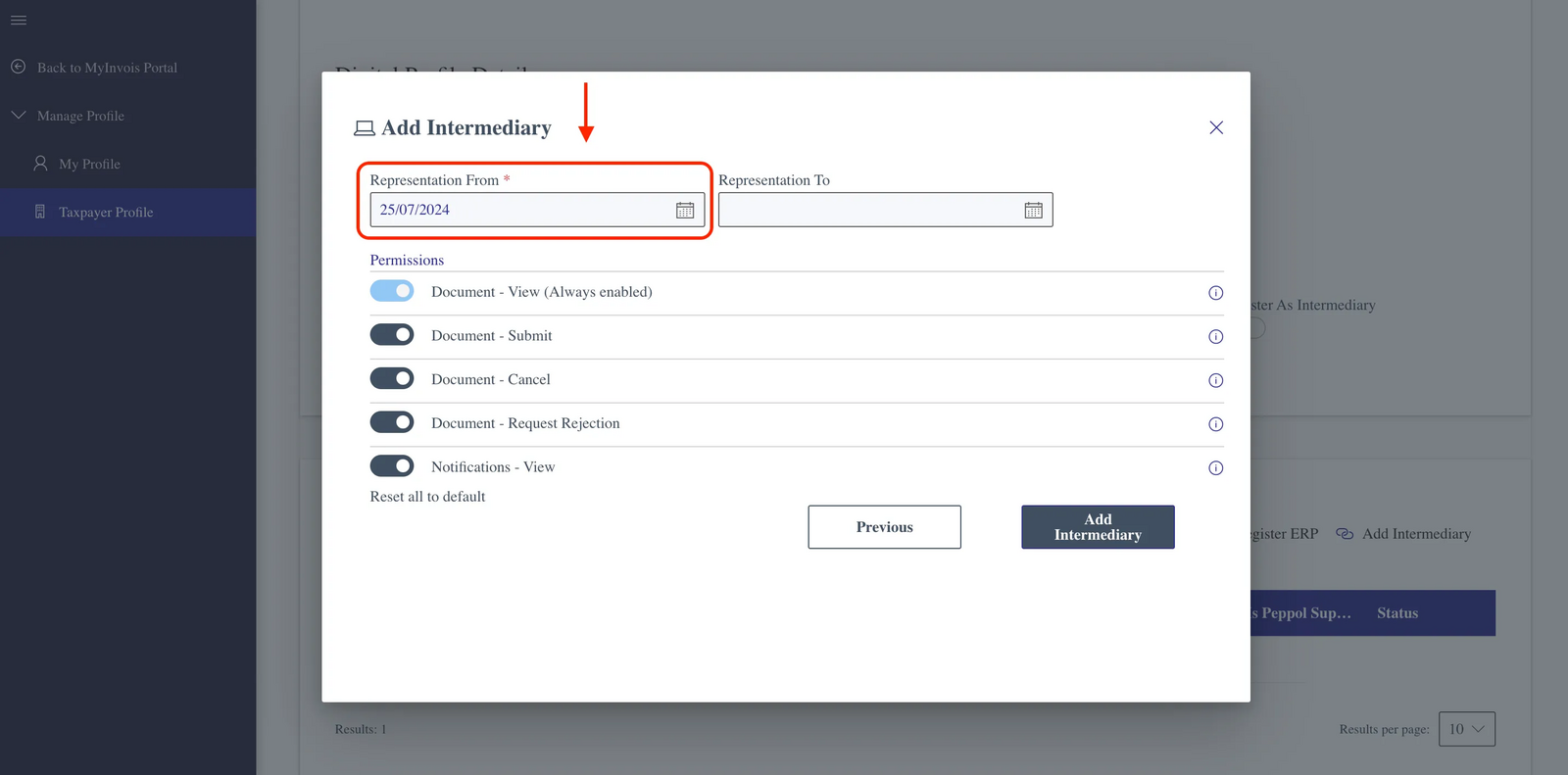

5. Set Representation Date: In the Representation From field, select today’s date. Leave the Representation To field blank to keep the access valid indefinitely (as shown in the image).

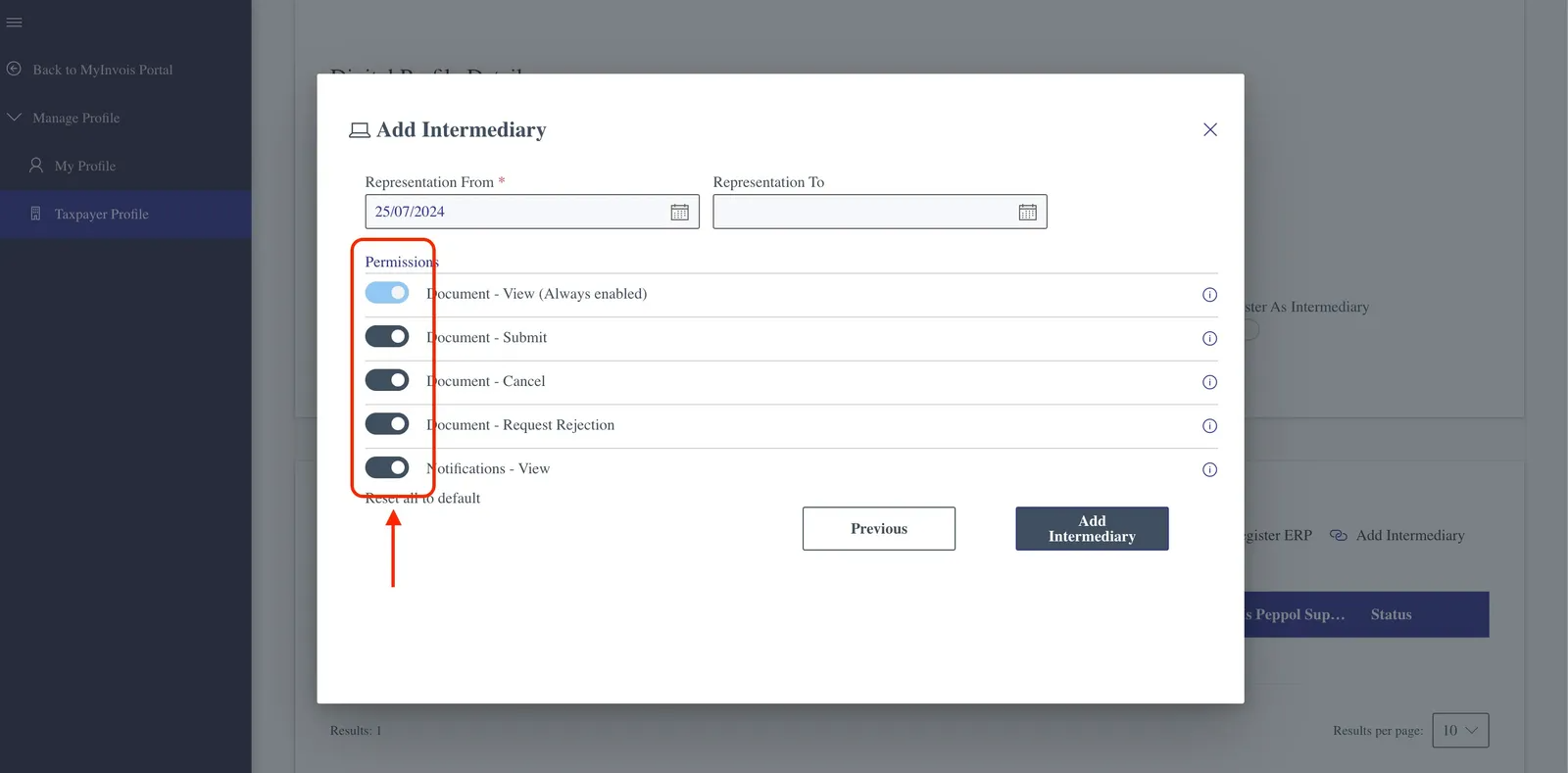

6. Enable Permission and Finalize: Make sure that all permission checkboxes are enabled before clicking on “Add Intermediary” to complete the setup.

You’ll be redirected to a confirmation page — and EasyStore will now appear as your linked intermediary.

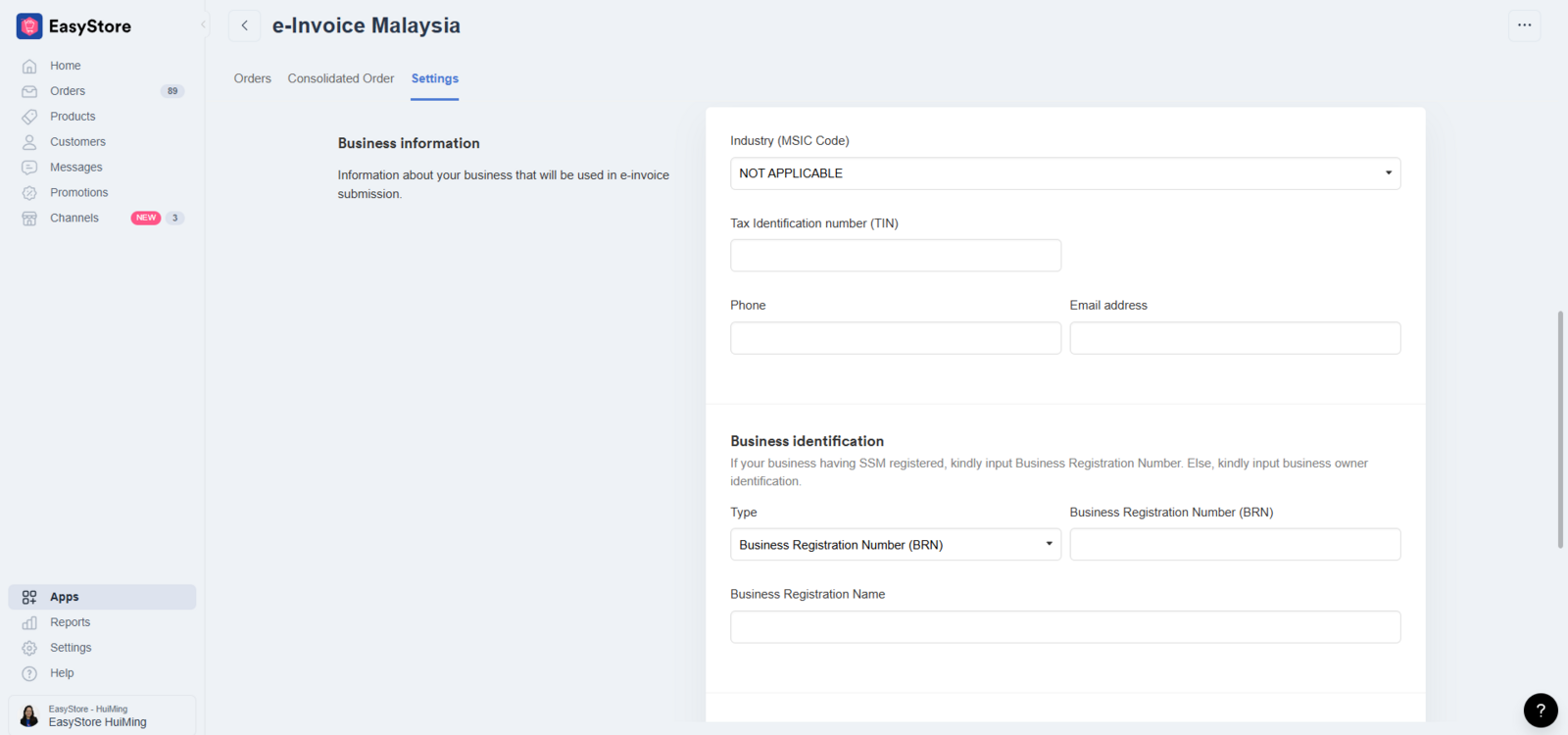

Step 3: Configure e-Invoice Setting in EasyStore

Now that EasyStore is officially recognized as your intermediary, the next move is to sync everything up on your end. And yes, it’s simpler than it sounds.

Start by installing the e-Invoice Malaysia app from your EasyStore admin panel. This app is your direct line to LHDN’s MyInvois system.

Once the app is in place, you’ll be prompted to complete your business profile. This part’s all about making sure your tax details are accurate and compliant:

- Industry code

- Registration info

- Contact details

- Your TIN

Take a moment here to double-check everything matches your SSM registration. Once that’s done, just hit "Save" and "Verify", and you’re ready to roll.

Pro tip: Having your tax information sorted now saves you a lot of trouble down the line.

e-Invoice Ready with EasyStore

EasyStore facilitates e-invoice submission across online and retail channels, enabling Malaysian SMEs that run e-commerce and retail operations to experience seamless and automated invoicing.

- Collect and Remember Customer Tax Info: EasyStore supports e-invoices by collecting and remembering customer tax info (TIN or IC number). This feature ensures that your customers' tax details are always available, reducing repetitive data entry and enhancing the overall experience.

- Auto e-invoice Submission: Once transaction is successful, the order details will automatically submit to LHDN through API integration and validated within 2 seconds. Upon approval, both customers and businesses receive instant notifications on the status.

- Customer e-invoice QR Code: Customers can access their e-invoice details through the QR code available across online store, shopping app, and POS orders.

- Support 3rd party e-Invoice submission: For businesses that prefer to submit e-invoices through accounting software, EasyStore’s e-invoice tool can streamline the collection of customer tax info for later submission through the accounting software.

- E-Invoice Dashboard: Securely store the e-invoice for future reference and compliance purposes. EasyStore keeps your records organized and easily accessible, meeting all regulatory requirements.

线上线下融合,UCX 客户体验为王

选择 EasyStore,意味着选择一个能让您的业务实现无缝整合、高效运作的可信赖合作伙伴。让我们共同开启您的多渠道经营之旅,探索更广阔的商业可能性。

欢迎联系我们,了解更多How Businesses Can Leverage e-Invoices

Here’s how your business can benefit from e-invoice tools and position itself as customer-centric.

- More Customer Touchpoints: Offering to assist customers with e-invoices provides additional touchpoints, enhancing customer interactions. It shows that your business is proactive in meeting customer needs and can significantly improve customer satisfaction and loyalty.

- E-Invoice Tools for Customers: Having e-invoice tools readily available makes the process seamless for customers. When customers find it easy to receive and manage their e-invoices, they are more likely to perceive your brand as customer-first. This perception can differentiate your business from competitors and foster long-term customer relationships.

- Customer Data Collection: e-Invoices provide an excellent opportunity to collect customer data. Use this data to personalize experiences and tailor your offerings to better meet your customers' needs.

Best Practice for Managing e-Invoice Cancellation

Orders don’t always go as planned which cancellations or updates from customers can happen anytime. Here’s how such changes are handled within the e-Invoice system.

If Changes/ Cancellation Happens Within 72 Hours:

Changes in Orders:

The system will automatically cancel the previous invoice submitted to LHDN and reissue a new invoice to LHDN.

Note: e-Invoice cancellation is only allowed within 72 hours after being validated by LHDN.

Order Cancellation:

If an order is being cancelled within 72 hours after e-invoice is submitted, the system will automatically cancel the e-Invoice

If the Changes/ Cancellation Happens After 72 Hours:

Changes of Orders:

- A Debit Note for additional charges (if the invoice amount increases).

A Credit Note for reductions (if the invoice amount decreases)

Conclusion

Recognizing that e-Invoicing is a new concept for many SMEs, EasyStore aims to lower the barrier to adoption by providing this functionality without any additional charges.

As e-Invoice regulations may change, EasyStore works closely with authorities to ensure SMEs stay ahead of compliance requirements, helping them navigate the learning curve and move forward in streamlining their business processes while creating a more engaging and satisfying experience for customers

Embrace the digital transformation with EasyStore and position your brand as a leader in customer-first business practices.

EasyStore Unified Commerce Solution

EasyStore is a unified commerce solution that unifies retail and ecommerce business.

Over 50,000 brands have grown their businesses by embracing unified customer experiences (UCX) strategy through EasyStore across multiple sales channels - online store, retail outlets, marketplaces, and social media, ensuring consistency in product and service offerings for a seamless shopping journey.

线上线下融合,UCX 客户体验为王

选择 EasyStore,意味着选择一个能让您的业务实现无缝整合、高效运作的可信赖合作伙伴。让我们共同开启您的多渠道经营之旅,探索更广阔的商业可能性。

欢迎联系我们,了解更多最新文章

-

May 2025 Product Updates

By Cavan Koh · 5th May, 2025

-

April 2025 Product Updates

By Cavan Koh · 13th Apr, 2025

-

March 2025 Product Updates

By Cavan Koh · 9th Mar, 2025

-

How These Retailers Use UCX to Prepare for Ramadan—and Keep Customers Coming Back

By Frost Chen, Poh Sook Yan · 2nd Mar, 2025

-

1,000 SMEs to Benefit: EasyStore and Partners Sign MoU to Empower Unified Customer Experience (UCX) for Retail and Ecommerce

By EasyStore Press · 26th Feb, 2025

-

Let Business Help Business Supports Over 1000 Local SMEs Across Malaysia

By Amirul Asraf · 15th Feb, 2025