3 Tips of Choosing Your Payment Gateway

By Fadila Aziz · 17th January, 2015

This blog was updated on 11 March 2025, for more information connect with our team: https://www.easystore.co/contact

What is a Payment Gateway?

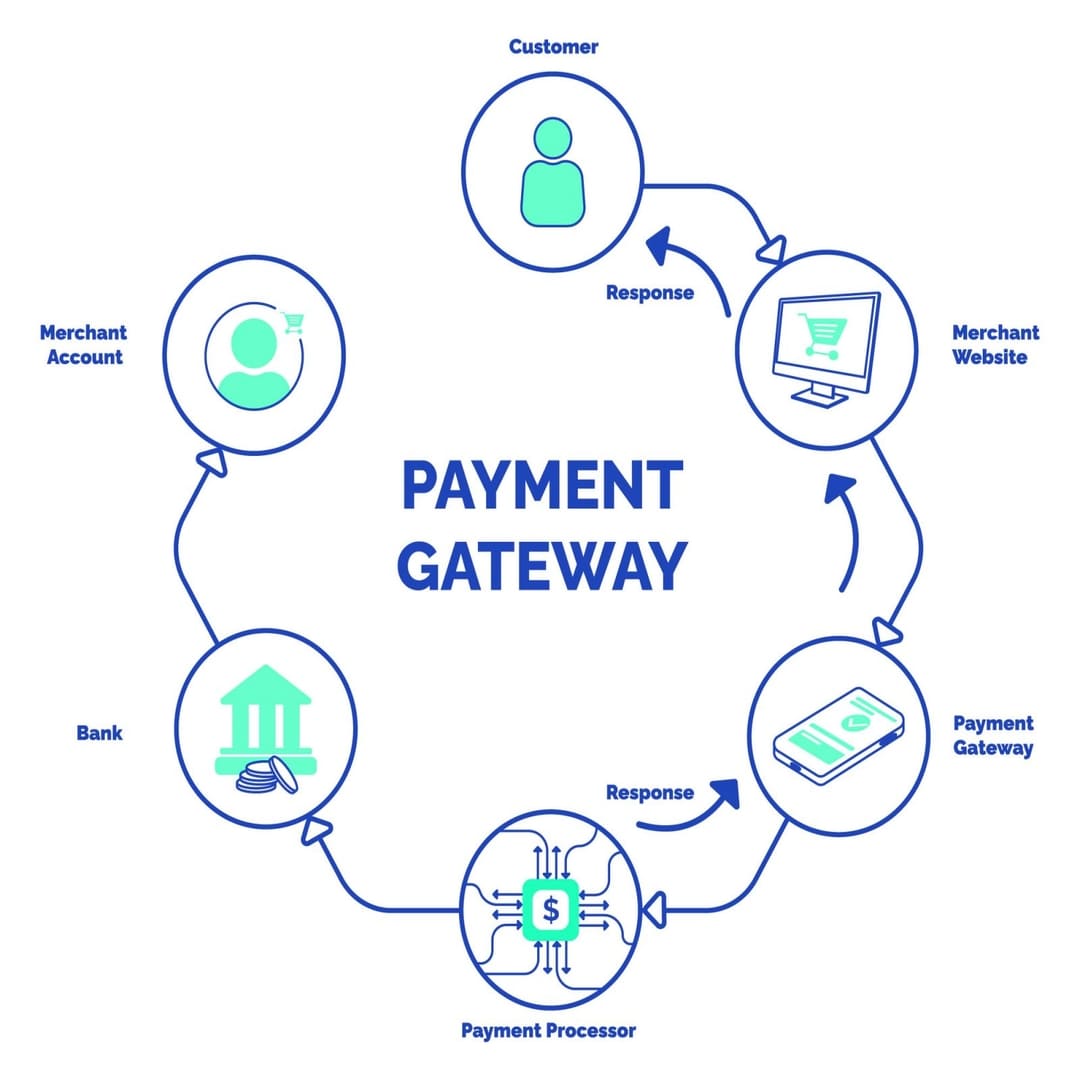

A payment gateway is a must-have for e-commerce businesses, online retailers, and even physical stores with online sales. It securely processes credit and debit card payments, acting as a bridge between customers and merchants.

For a successful e-commerce business, factors like brand reputation, product quality, security, and smooth checkout all matter. A reliable payment gateway ensures hassle-free transactions, keeping customers happy.

Imagine a shopper wanting to buy from your store but realizing they can’t pay with their card—frustrating, right? While cash deposits are an option, they’re inconvenient and time-consuming. Instead, offer a fast, secure, and easy online payment experience to boost sales and customer satisfaction.

Here are three essential tips for choosing the right payment gateway:

1. Low Transaction Fees

As a merchant, it's crucial to understand that transaction fees are typically covered by the seller, not the buyer. This means you need to select a payment gateway that offers competitive transaction fees for both credit card and online banking payments.

These fees are deducted from the total transaction amount, so choosing a gateway with low fees helps maximize your profit margins.

2. Stability & Reliability

A stable and secure payment gateway is critical for smooth business operations. Your customers will be making payments through various banks and payment methods, so ensure your chosen gateway can process payments from a wide range of banks and card providers.

Additionally, if your business experiences high transaction volumes, select a payment gateway that operates 24/7 with minimal downtime, even during peak hours.

3. 24-Hour Holding Period for Credit Card Payments

Credit card transactions made through a payment gateway typically take up to 24 hours to be fully processed. During this time, customers can request a chargeback for reasons such as unauthorized transactions, stolen cards, or accidental purchases.

To prevent losses due to fraud or chargebacks, implement a 24-hour holding period before shipping products. If you dispatch an order immediately after payment and the customer later cancels the transaction, you could lose both the product and the payment. By waiting 24 hours, you can ensure that the payment is finalized before fulfilling the order.

Understanding how payment gateways work is crucial for e-commerce success. By choosing a low-cost, stable, and secure gateway while implementing a 24-hour holding period, you can protect your business from fraud and financial losses.

Start with the right payment gateway to offer your customers a seamless shopping experience while safeguarding your business transactions.

Make Customers Love Buying From You

EasyStore empowers your brand to prioritize customers and enhance their experience, creating a unified customer experience (UCX) that makes customers love buying from you.

Over 50,000 brands have grown their businesses by embracing unified customer experiences (UCX) strategy through EasyStore across multiple sales channels - online store, retail outlets, marketplaces, and social media, ensuring consistency in product and service offerings for a seamless shopping journey.

线上线下融合,UCX 客户体验为王

选择 EasyStore,意味着选择一个能让您的业务实现无缝整合、高效运作的可信赖合作伙伴。让我们共同开启您的多渠道经营之旅,探索更广阔的商业可能性。

欢迎联系我们,了解更多最新文章

-

March 2025 Product Updates

By Cavan Koh · 9th Mar, 2025

-

How These Retailers Use UCX to Prepare for Ramadan—and Keep Customers Coming Back

By Frost Chen, Poh Sook Yan · 2nd Mar, 2025

-

1,000 SMEs to Benefit: EasyStore and Partners Sign MoU to Empower Unified Customer Experience (UCX) for Retail and Ecommerce

By EasyStore Press · 26th Feb, 2025

-

Let Business Help Business Supports Over 1000 Local SMEs Across Malaysia

By Amirul Asraf · 15th Feb, 2025

-

EasyStore Launches Brand App: A Game-Changer For Customer Experience

By Kelie Wong · 13th Feb, 2025

-

February 2025 Product Updates

By Cavan Koh · 9th Feb, 2025