How to Prepare for Malaysia’s E-Invoicing Rollout with EasyStore

By Cavan Koh · 31st July, 2024

文章目錄

This blog was updated on 27 May 2025, for more information connect with our team: https://www.easystore.co/contact

Malaysia’s E-Invoicing Starts August 1, 2024

The Inland Revenue Board (IRB) will begin implementing e-Invoicing in phases starting August 2024.

This initiative applies to all businesses in Malaysia involved in commercial activities, including domestic and cross-border transactions.

E-Invoice Implementation Timeline

| 1 August 2024 | > RM 100 million |

| 1 January 2025 | RM 25 million – RM 100 million |

| 1 July 2025 | RM 500,000 – RM 25 million |

| 1 January 2026 | All businesses |

Disclaimer: E-Invoicing regulations may change. For the latest updates, visit the LHDN website.

What is an E-Invoice?

An e-invoice is a digital version of a traditional invoice.

It contains the same essential details but is created, sent, and stored electronically—helping reduce errors, improve efficiency, and ensure compliance.

4 Types of E-Invoices

Invoice – A bill issued by a seller to a buyer listing goods or services and the total amount.

Debit Note – Used to increase the amount payable (e.g. due to undercharges or additional items).

Credit Note – Used to reduce the amount payable (e.g. for refunds or discounts).

Refund – Issued to return funds for overpayments or returned goods.

2 Ways to Submit E-Invoices

1. Manual Submission via MyInvois Portal

Log in and manually upload your e-invoice.

2. Automated Submission via API

Integrate your system directly with the MyInvois API for automated submission.

EasyStore supports free e-Invoice API submission.

How to Enable E-Invoicing with EasyStore

Step 1: Register on MyInvois Portal

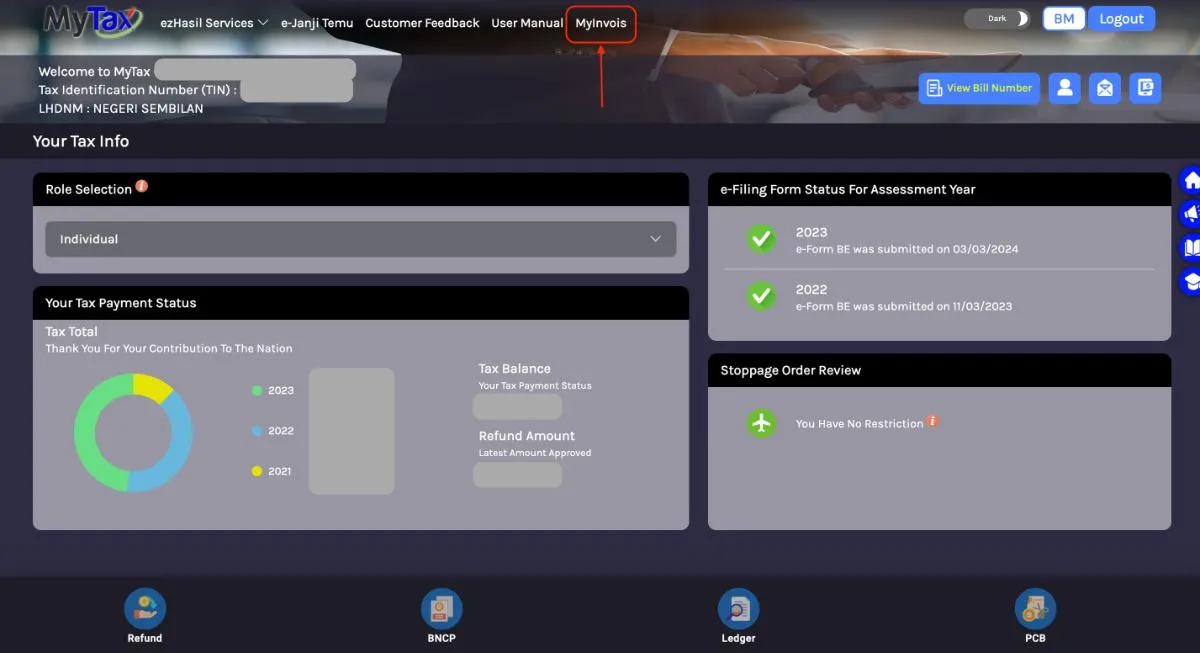

Create a MyInvois account at https://mytax.hasil.gov.my.

Log in, go to the MyInvois section, and complete your setup.

Already registered? Skip to Step 2.

Step 2: Add EasyStore as Your Intermediary

1. Log in to MyInvois and go to Taxpayer Profile.

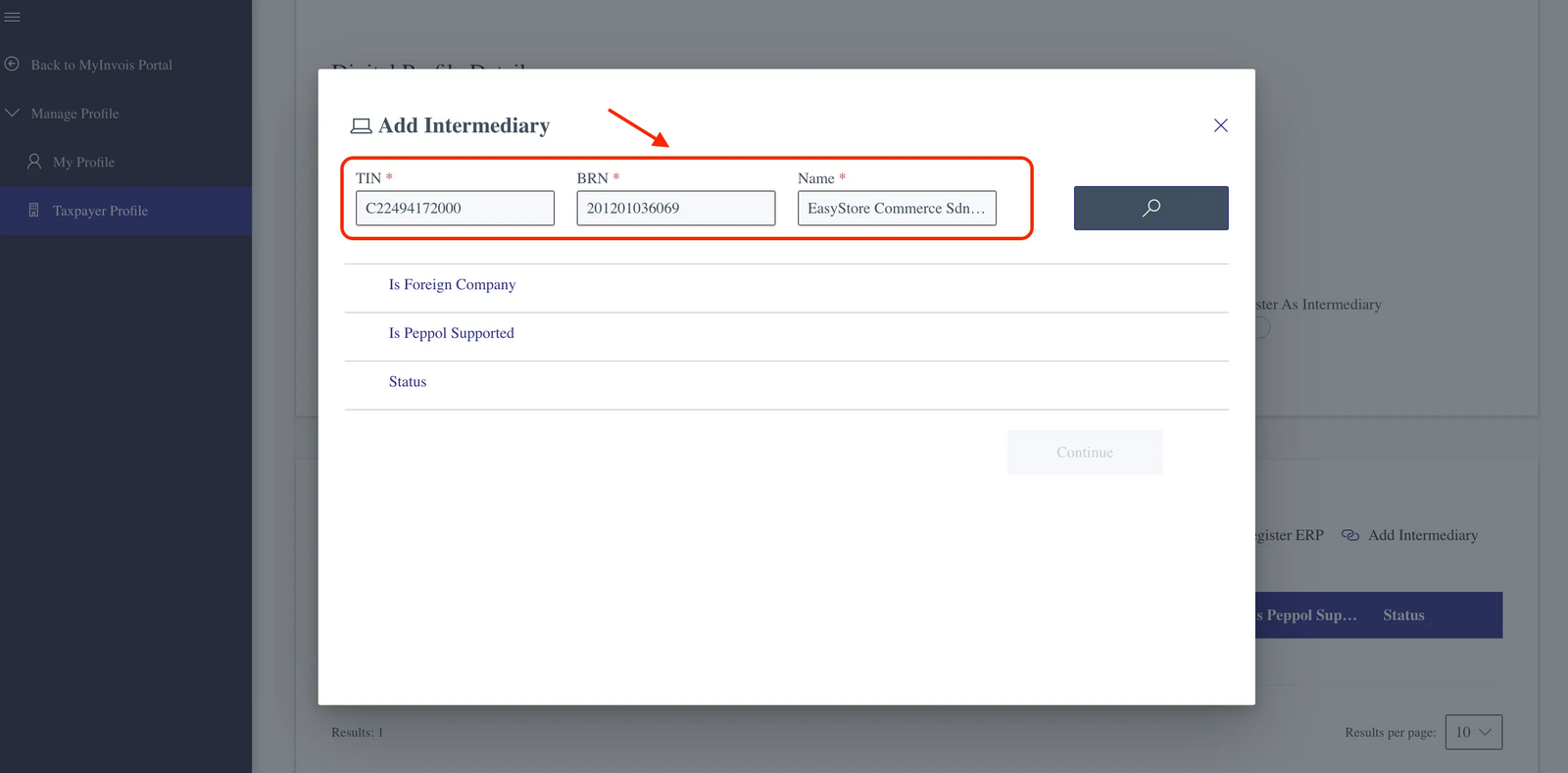

2. Click Add Intermediary under the Representatives section.

3. Enter EasyStore’s details:

TIN: C22494172000

BRN: 201201036069

Name: EasyStore Commerce Sdn. Bhd.

4. Click Search, then Continue.

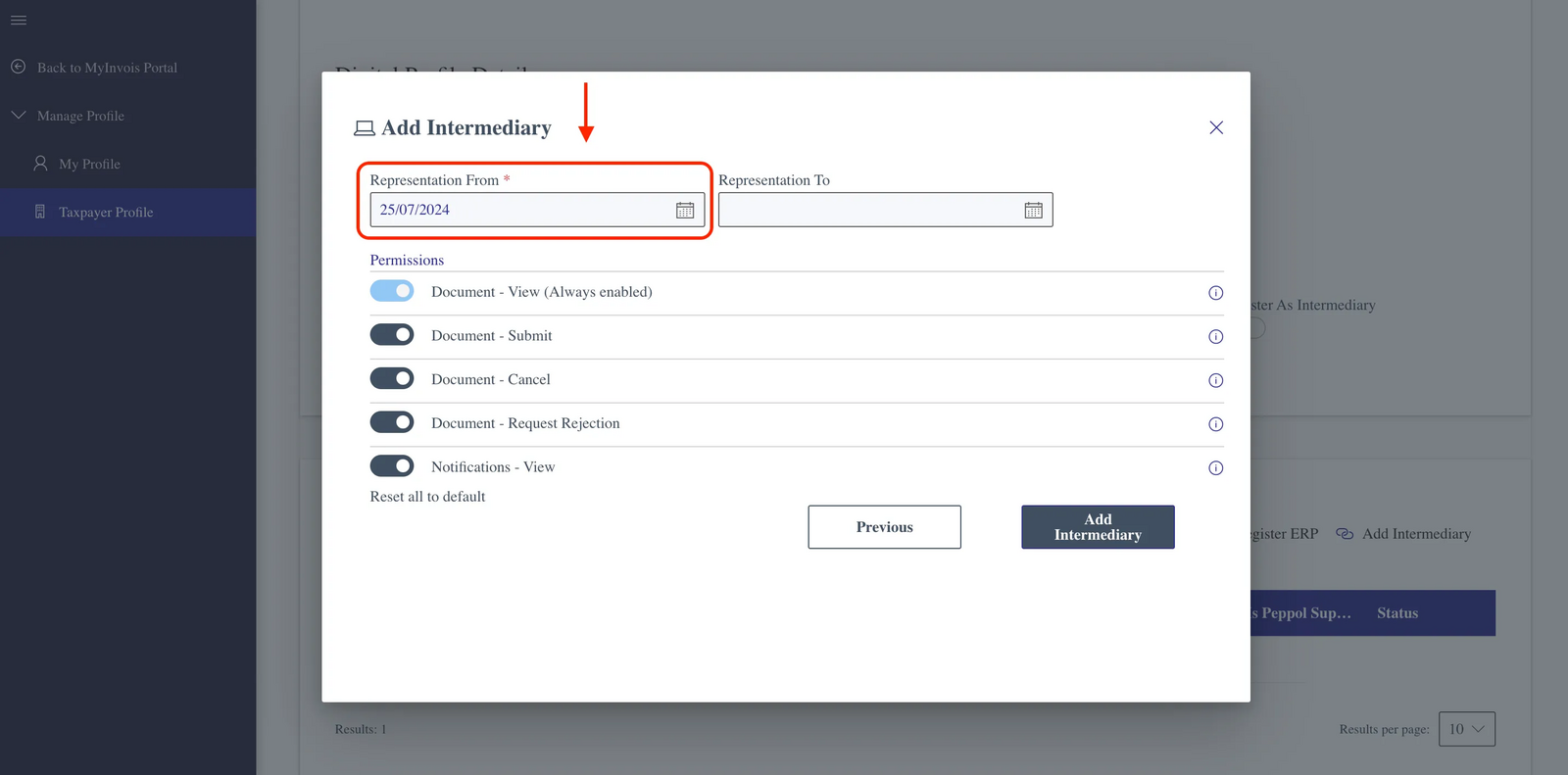

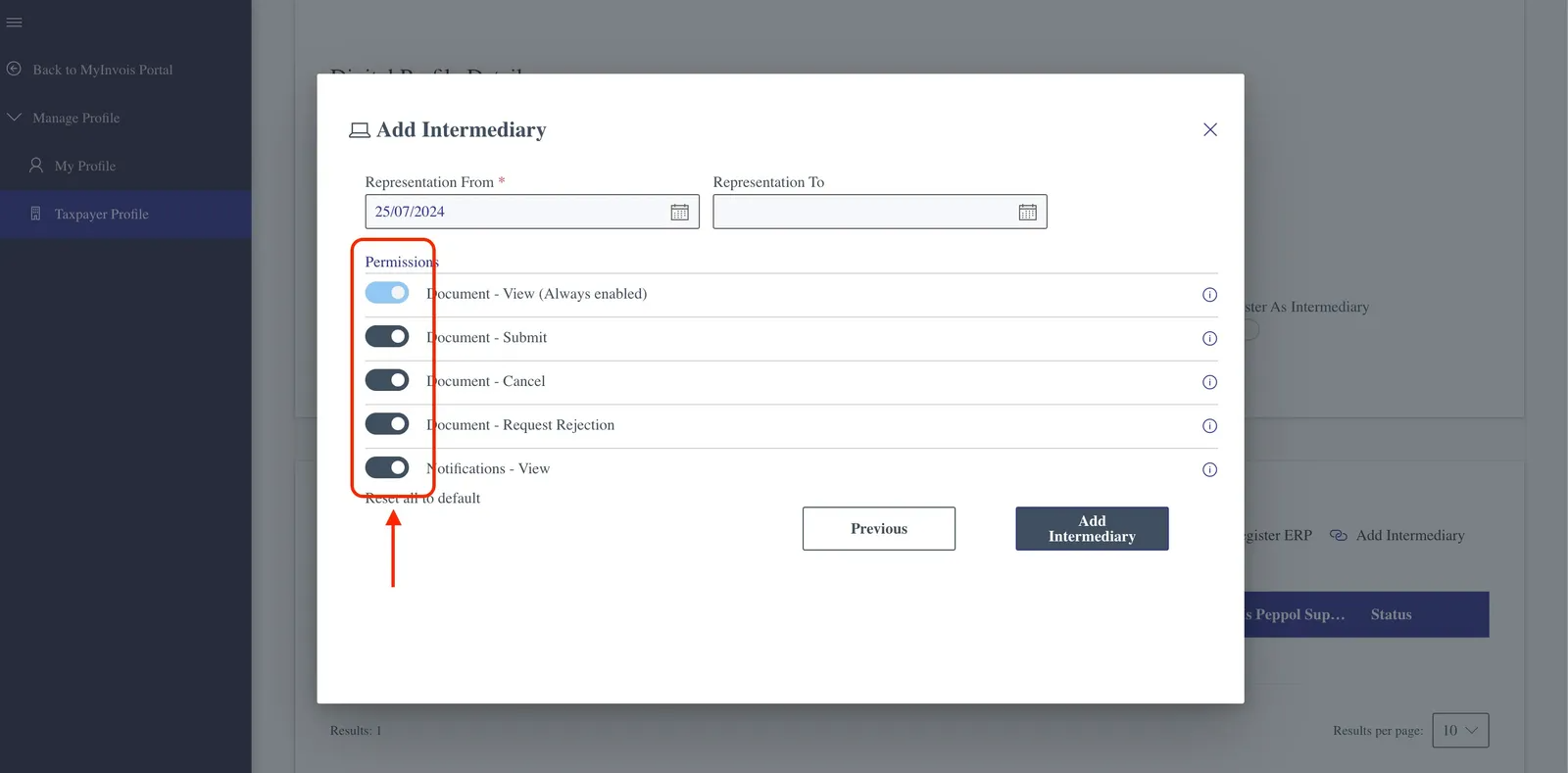

5. Set the “Representation From” date as today. Leave the “To” date blank.

6. Enable all permission checkboxes and click Add Intermediary.

You’ll be redirected to a confirmation page — and EasyStore will now appear as your linked intermediary.

EasyStore will now appear as your official intermediary.

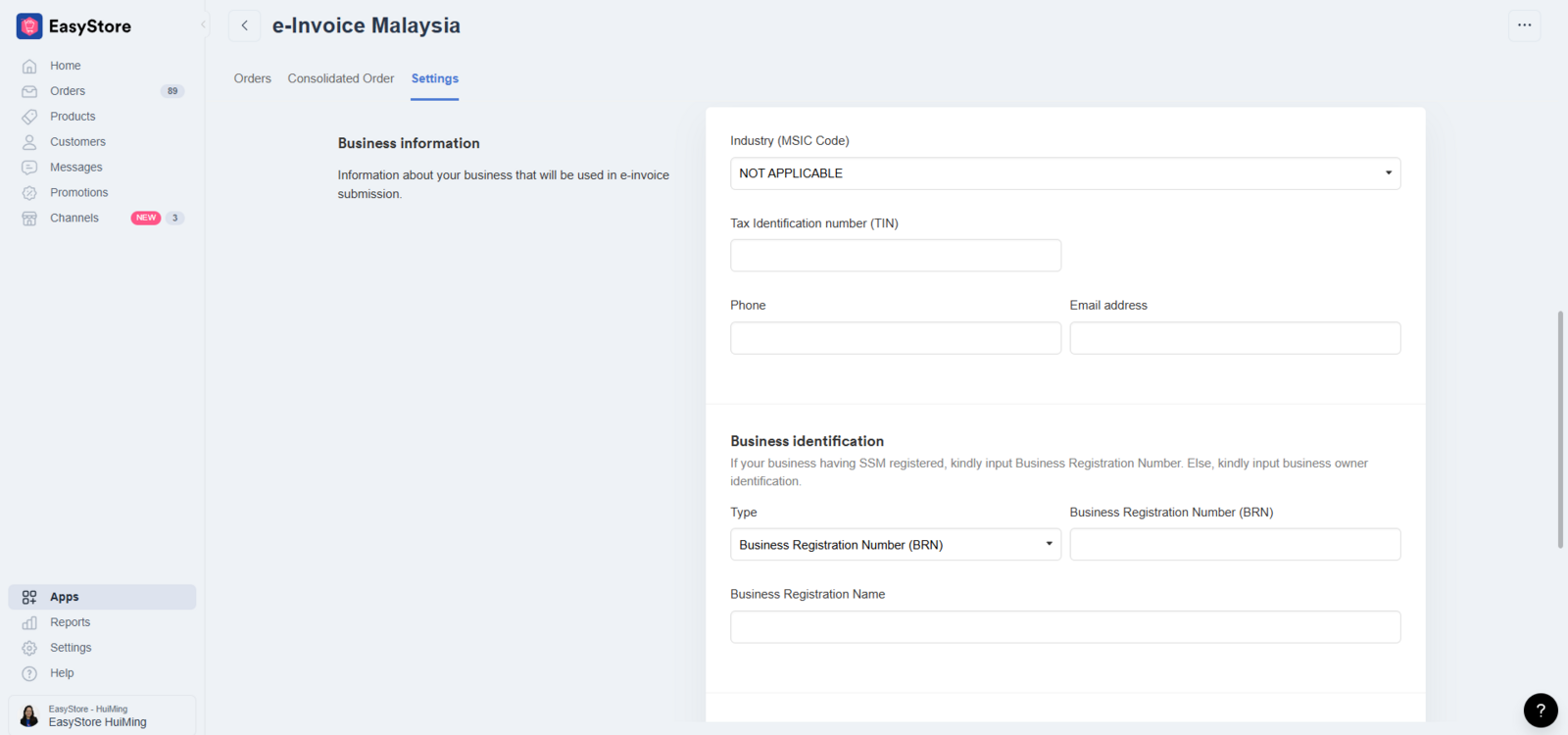

Step 3: Set Up E-Invoice in EasyStore

Install the E-Invoice Malaysia app from your EasyStore admin panel.

Complete your business profile (industry code, TIN, contact info, etc.).

Verify the details and save.

Tip: Ensure all business info matches your SSM registration to avoid verification issues.

EasyStore’s E-Invoicing Features

- Auto Submission via API

After a transaction, order details are submitted to LHDN within 2 seconds. Both the business and customer receive instant updates on e-invoice status.

- Customer Tax Info Storage

EasyStore securely collects and stores customer TIN/IC numbers to simplify future transactions.

- QR Code Access for Customers

Customers can view e-invoices via QR codes on their online store, shopping app, and POS orders.

- Third-Party Integration Support

Prefer to use your accounting software? EasyStore can collect tax info for submission via external platforms.

- E-Invoice Dashboard

Easily access and manage your e-invoices for future reference and compliance.

Why E-Invoicing Benefits Your Business

- More Touchpoints

Offering e-invoices enhances the customer journey, showing your business is proactive and compliant.

- Streamlined Customer Tools

A smooth e-invoice experience builds trust and encourages customer loyalty.

- Valuable Customer Data

Use collected data to personalize offers and improve your marketing strategies.

Handling E-Invoice Cancellations

If changes or cancellations occur:

- Within 72 hours

The system will auto-cancel the original invoice and resubmit a new one to LHDN.

- After 72 hours

Use a Debit Note (if the amount increases) or a Credit Note (if it decreases).

Final Thoughts

Understanding e-Invoicing may be new to many SMEs, but EasyStore aims to simplify the process.

With no additional charges, built-in automation, and up-to-date compliance support, businesses can confidently move forward.

Stay ahead of regulatory changes and give your customers a better experience by embracing digital invoicing with EasyStore.

Let EasyStore handle the compliance—so you can focus on growing your business.

Make Customers Love Buying From You

EasyStore empowers your brand to prioritize customers and enhance their experience, creating a unified customer experience (UCX) that makes customers love buying from you.

Over 50,000 brands have grown their businesses by embracing unified customer experiences (UCX) strategy through EasyStore across multiple sales channels - online store, retail outlets, marketplaces, and social media, ensuring consistency in product and service offerings for a seamless shopping journey.

Embrace UCX and redefine your business success today

Discover how UCX can elevate your customer engagement with a truly unified journey for your customers, streamline operations, and drive growth across all channels.

Contact Us