6 Benefits of Buy Now, Pay Later (BNPL) For SMEs

By Eric Lian · 9th February, 2022

As ecommerce continues to grow in Malaysia, many processes that are considered norm in running an online business has been overshadowed by newer and better processes. However, with the infamous COVID-19, we are seeing salary cuts, lost jobs. It has cost a shift in consumer buying behavior.

Therefore, the emergence of Buy Now, Pay Later (BNPL) has become one of the most significant changes in the market.

What started as a payment that was only suitable for high ticket items, has now become a promising payment method for any type of items for businesses. It is also said that the majority of the consumer would prefer BNPL over credit card payment. Therefore, it has grown popular and businesses have been adopting BNPL to their business processes.

But what exactly is BNPL and how well does it benefit your business? Today, we are going to dive into the sizable benefits. Let’s read on.

What is BNPL?

Buy Now, Pay Later (BNPL) is always associated with installment payment in nature. Yes, installments eases consumer spending with flexibility but the payments are also dragged in a longer time frame so it does not significantly increase your sales, and businesses will have to bear the risk of consumers running off paying you.

However, the BNPL model allows your business to be paid upfront, while the payment partners will deal with the risk and responsibility of getting the payments from your customers. In simpler terms, your customers can pay over time, and you get paid right away, a win-win situation for both you and your customers.

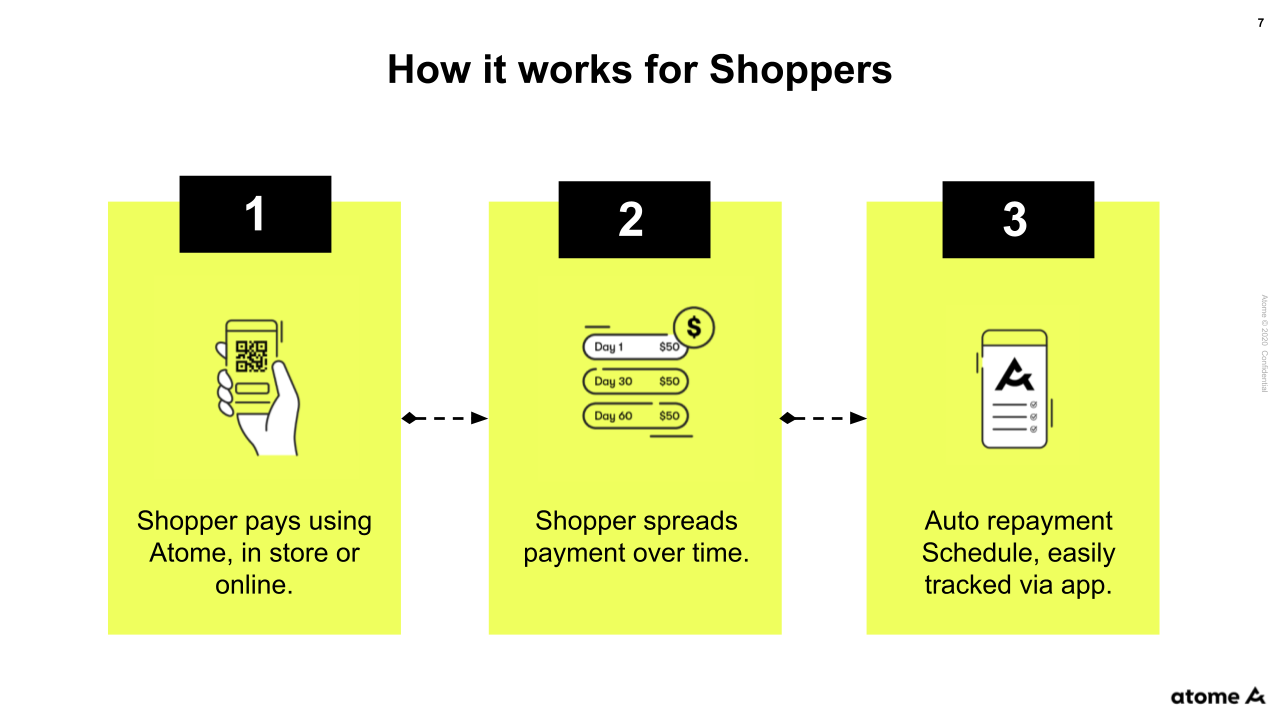

How does it work?

Typically when a customer makes a purchase from a certain retailer, they will not be charged full fees. The payments are split into 3 or 6 months with 0% interest and no admin fees. As a merchant, you will in turn receive the full amount after deduction of transaction fees in a few days. The payment provider will bear the full liability.

Photo source: Atome

Why are consumers opting for BNPL?

Because it is more affordable

Because why not? Considering the large amount to be paid upfront using credit cards, BNPL provides a lower cost to purchase their desired item. Typically, consumers do not have to pay for any fees or interest compared to credit cards. This allows consumers to have more capabilities to make larger purchases, especially for Gen Z as they are not capable of opting for credit cards.

Providing flexibility for consumers

As an alternative to credit card payment, BNPL brings flexibility to consumers. Consumers can pay in flexible terms ranging from 3 months to 6 months, depending on the payment partners the business is working with. This makes the purchase frictionless as consumers can pay at a lower price upfront for the items they desire.

Why should your business adopt BNPL?

Increase your competitive advantage

Almost half of the consumers will buy from businesses that offer BNPL. In other words, your competitors are already providing BNPL payment to their customers. Having BNPL into your checkout flow enables your business to stay competitive, putting you on par or even beating your competitions that have not adapted to the payment method.

Increase overall sales

BNPL generally increases your overall sales. In fact, it could increase up 20%- 30%. Consumers are more likely to make the purchase if you are offering more flexible payment options to them. Plus, customers feel more comfortable when they know they have the ability to pay for it. Hence they are more willing to buy more items from you in one go.

Increase cart size or (AOV)

When your customers are able to buy more items with you, it contributes to a larger basket size and increases your store’s overall Average Order Value (AOV). So the higher the basket size, the better. When your customers know that they have the ability to spend more in the short term, they tend to add more items into their cart.

Increase Customers Lifetime Value (CLV)

We often say getting new customers is easier than retaining one. But customer retention is always the core objective for every business. Providing a BNPL payment option allows your customers to come back and buy from you repeatedly. This expresses loyalty to your brand because you are providing value to your customers in terms of shopping experience, this increases their Lifetime Value with you. The longer they stay, the more your business flourish.

We often say getting new customers is easier than retaining one. But customer retention is always the core objective for every business. Providing a BNPL payment option allows your customers to come back and buy from you repeatedly. This expresses loyalty to your brand because you are providing value to your customers in terms of shopping experience, this increases their Lifetime Value with you. The longer they stay, the more your business flourish.

Attract new customers

Including BNPL payment into your cart not only increases CLV but also attracts new customers. There are always customers that want to buy from you but do not have the money to buy upfront yet. So we categorize them as “visitors” or “leads”. Perhaps the only thing they are waiting for is for the price to go down, and that is where BNPL is the most probable way to convert them. Since they are able to pay at a lower cost with interest free, they are more prone to make the purchase from you.

Reduce cart abandonment

According to Mastercard, accepting BNPL payments reduces up to 35% abandoned carts. We also understand that most cart abandonments are due to the notion that the total price is often “too expensive” for them to click on the pay button. By offering BNPL, it greatly diminishes the turn off of high prices of the cart and encourages your customers to buy from you.Also, check out 12 ways to reduce abandoned cart

So, who should you find?

EasyStore is leading the industry with the most BNPL partners to take your business even further. We have integrated with multiple partners so you can choose which BNPL provider is best for your business. BNPL providers that are integrated with EasyStore are:

P/S: There is more to come!

Final thoughts

Adopting the Buy Now, Pay Later (BNPL) payment option for your business is extremely beneficial. If you haven't implemented a BNPL strategy for your business, do consider it part of your 2022 brand strategy.

Latest articles

-

April 2025 Product Updates

By Cavan Koh · 14th Apr, 2025

-

March 2025 Product Updates

By Cavan Koh · 10th Mar, 2025

-

How These Retailers Use UCX to Prepare for Ramadan—and Keep Customers Coming Back

By Frost Chen, Poh Sook Yan · 3rd Mar, 2025

-

1,000 SMEs to Benefit: EasyStore and Partners Sign MoU to Empower Unified Customer Experience (UCX) for Retail and Ecommerce

By EasyStore Press · 27th Feb, 2025

-

Let Business Help Business Supports Over 1000 Local SMEs Across Malaysia

By Amirul Asraf · 16th Feb, 2025

-

EasyStore Launches Brand App: A Game-Changer For Customer Experience

By Kelie Wong · 14th Feb, 2025